Debt Consultant Singapore: Specialist Solutions for Financial Administration

Debt Consultant Singapore: Specialist Solutions for Financial Administration

Blog Article

Discover Exactly How Specialist Debt Professional Services Can Help You Gain Back Financial Security and Manage Your Debt Successfully

In today's complicated financial landscape, several people locate themselves grappling with frustrating debt and unpredictability regarding their monetary future. Professional financial debt specialist solutions use an organized technique to reclaiming stability, supplying tailored methods and skilled insights made to deal with unique monetary challenges.

Recognizing Financial Obligation Specialist Services

Financial debt specialist solutions offer people and companies with specialist assistance in managing and settling monetary commitments. These services purpose to assist customers in browsing complicated financial landscapes, using customized techniques to resolve varying levels of financial debt. A debt professional usually reviews a client's monetary scenario, including earnings, expenses, and existing financial debts, to formulate a comprehensive plan that straightens with their unique requirements.

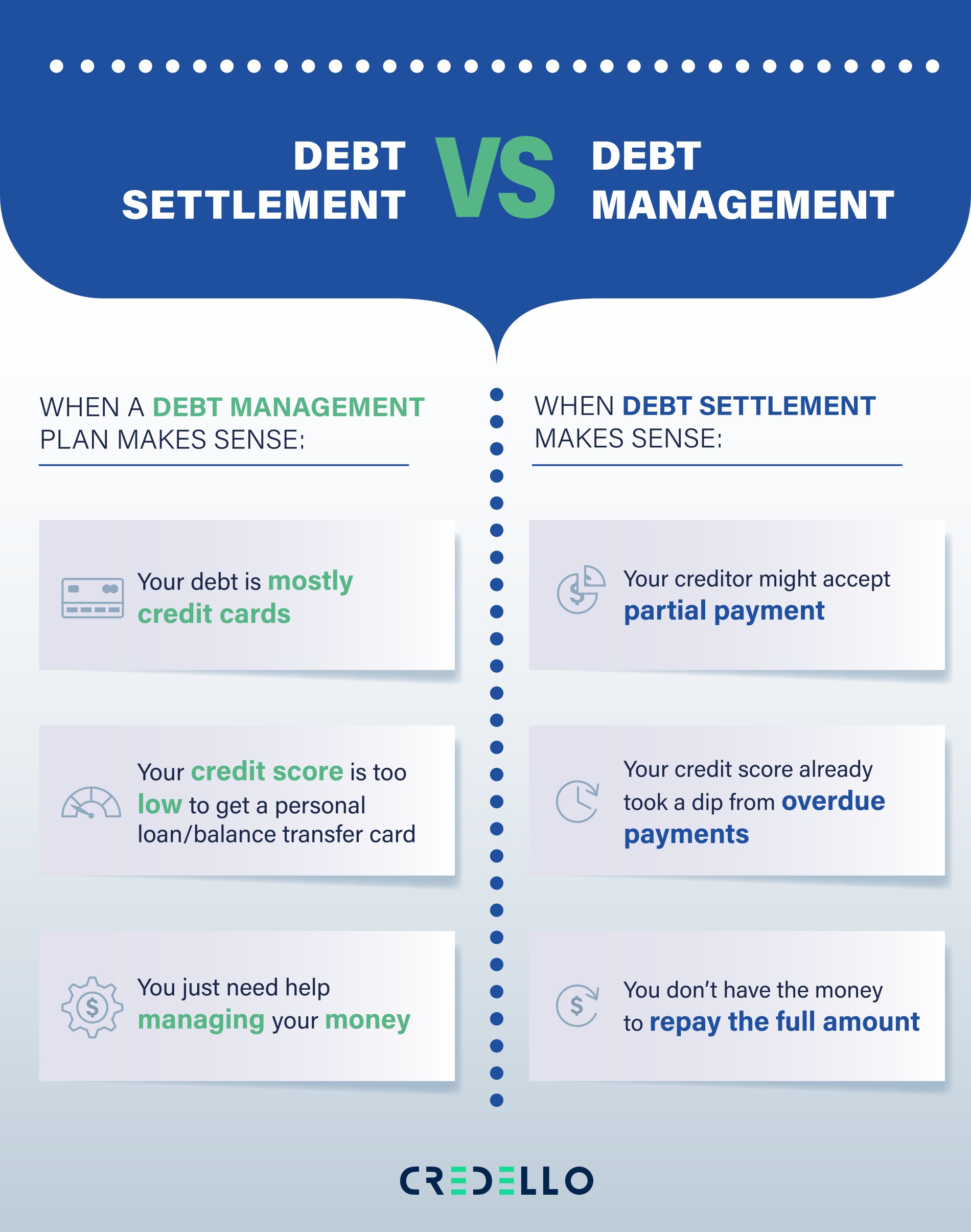

Professionals use a variety of approaches, such as budgeting help, debt consolidation choices, and arrangement with financial institutions - debt consultant singapore. By leveraging their knowledge, they can assist customers recognize the implications of their financial obligation, consisting of passion rates, repayment terms, and potential legal repercussions. Furthermore, professionals frequently educate clients about financial literacy, empowering them to make informed decisions that can cause lasting economic wellness

Moreover, these solutions might include developing structured settlement strategies that are lasting and workable. By collaborating closely with customers, financial obligation experts foster an encouraging atmosphere that motivates commitment to financial self-control. Overall, comprehending the scope and features of financial obligation expert solutions is critical for companies and people seeking efficient solutions to their economic obstacles, eventually leading the way to higher financial stability.

Advantages of Expert Guidance

Specialist assistance in the red monitoring supplies countless advantages that can significantly boost an individual's or business's monetary situation. Among the primary advantages is access to specialist understanding and experience. Financial debt experts possess a deep understanding of different financial products, lawful policies, and market problems, enabling them to give informed suggestions tailored to certain circumstances.

Additionally, debt experts can supply settlement abilities that individuals may do not have. They can interact properly with creditors, possibly safeguarding better repayment terms or lowered interest rates. This campaigning for can bring about much more desirable outcomes than individuals might accomplish by themselves.

Tailored Strategies for Financial Obligation Administration

Reliable financial obligation monitoring calls for greater than just a fundamental understanding of monetary commitments; it requires approaches tailored to a person's one-of-a-kind circumstances. Everyone's monetary circumstance is unique, affected by numerous variables such as revenue, expenses, debt background, and individual objectives. Specialist financial debt professionals succeed in developing personalized plans that deal with these particular components.

With a detailed assessment, experts identify the most pressing debts and analyze spending habits. They can after that recommend efficient budgeting methods that align with one's way of living while focusing on debt repayment (debt consultant singapore). Additionally, consultants might recommend debt consolidation methods or settlement tactics with creditors to reduced rate of interest rates or develop workable payment strategies

A considerable advantage of tailored strategies is the versatility they offer. As scenarios change-- such as work loss or increased expenditures-- these approaches can be adjusted appropriately, ensuring continuous importance and effectiveness. In addition, consultants supply ongoing support and education and learning, empowering individuals to make enlightened decisions in the future.

Eventually, customized financial debt management methods not only help with instant remedy for economic problems yet likewise foster long-term monetary stability, allowing individuals to restore control over their finances and attain their monetary goals.

Just How to Select a Consultant

Just how can one guarantee that they pick the appropriate financial debt professional for their needs? Picking a debt professional needs mindful consideration of several vital aspects. Initially, analyze their certifications and experience. Search for professionals with pertinent certifications, such as those from the National Foundation for Credit Scores Therapy (NFCC) or the Organization of Debt Therapy Specialists (ACCP) Their proficiency in managing debt solutions is crucial.

Next, evaluate their online reputation. Study on the internet reviews and endorsements to assess the experiences of past customers. A reputable professional will frequently have favorable comments and a track record of effective financial obligation management results.

It is also necessary to recognize their method to financial debt administration. Schedule an webpage appointment to discuss their approaches and ensure they straighten with your monetary objectives. Openness regarding fees and solutions is crucial; a trustworthy specialist ought to give a clear rundown of prices involved.

Lastly, take into consideration the consultant's communication style. Choose someone click here now who pays attention to your concerns and responses your concerns clearly. A strong relationship can foster a collaborative relationship, crucial for efficiently managing your financial debt and attaining economic security.

Steps to Accomplish Financial Security

Accomplishing economic security is a methodical process that includes a series of calculated steps customized to private conditions. The primary step is to assess your current financial situation, consisting of earnings, expenditures, possessions, and debts. This comprehensive examination supplies a clear picture of where you stand and aids recognize areas for improvement.

Next, create a reasonable spending plan that focuses on necessary expenses while alloting funds for financial debt payment and cost savings. Sticking to this spending plan is critical for preserving financial technique. Following this, discover financial obligation monitoring alternatives, such as debt consolidation or negotiation, to minimize rates of interest and month-to-month payments.

Establish a reserve to cover unforeseen expenses, which can prevent reliance on credit report and additional financial obligation build-up. Once immediate monetary pressures are addressed, concentrate on long-term economic goals, such as retirement savings or financial investment techniques.

Final Thought

To conclude, expert debt consultant services provide useful sources for individuals seeking monetary security. By providing expert assistance, customized methods, and recurring assistance, these experts promote reliable financial debt administration. Their capacity to discuss with creditors and produce tailored payment plans substantially improves the likelihood of achieving financial recuperation. Eventually, engaging with a debt expert can lead to an extra enlightened method to individual financing, fostering lasting security and assurance.

In today's complicated financial landscape, numerous people discover themselves grappling with overwhelming financial obligation and uncertainty about their economic future. Specialist financial obligation expert solutions offer an organized method to reclaiming stability, offering tailored techniques and expert insights developed to address unique monetary difficulties. A financial debt professional usually reviews a customer's monetary circumstance, consisting of income, expenses, and special info existing financial obligations, to develop an extensive plan that straightens with their one-of-a-kind needs.

Generally, comprehending the extent and features of financial obligation expert services is critical for individuals and organizations seeking efficient services to their monetary obstacles, inevitably leading the way to greater monetary security.

In final thought, expert financial obligation professional services offer important sources for individuals looking for financial stability.

Report this page